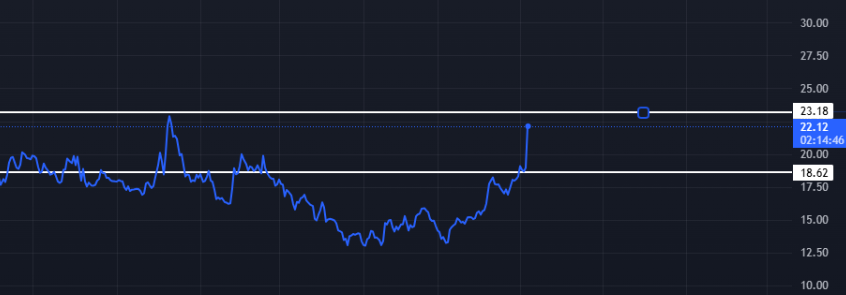

JP Power (Jaiprakash Power Ventures Ltd) has surged nearly 14% in recent sessions, reflecting rising investor interest following a successful AGM and improving sentiment. With the share price now hovering around ₹22, traders are assessing whether this momentum can continue—or whether resistance near ₹23.18 could trigger a pullback.

Market Sentiment and Technical Strength

The AGM lifted investor confidence, leading to a breakout from recent consolidation. Momentum scores from StockEdge indicate strong buying interest:

- 1 Month: 83/100

- 3 Months: 83/100

- 6 Months: 78/100

These suggest that the stock is in a bullish phase, although it now approaches a critical technical barrier.

Crucial Levels to Watch

- Resistance: ₹23.18 – the breakout level

- Support: ₹18.62 – key downside protection

- Current Price: ₹22

While momentum is positive, buying near resistance without confirmation can be risky. A drop to support from current levels would imply an 18% decline—making a tight risk plan essential.

Also Read: JSW Energy Share Sentiment Turns Positive, But Price Action Remains Subdued

Entry Strategy

- Safer Entry: Wait for a confirmed breakout above ₹23.18 with strong volume. Use this level as a stop loss.

- Aggressive Entry: If entering now, reduce position size and keep a stop loss at ₹18.62. This limits potential capital loss if the stock reverses.

- Avoid Fixed Targets: In trending markets, price can move far beyond predicted levels. Rather than aiming for a rigid target, trail your stop loss using higher swing lows to stay in the trade while the trend is intact.

Exit Plan

- Monitor price behavior closely. Exit when the stock breaks below its recent swing lows, which often indicates a short-term trend reversal.

- This approach helps protect gains without limiting upside potential.

JP Power is in a strong momentum phase backed by improving sentiment and technical breakout potential. But with the stock near resistance, risk-managed entries and dynamic exits are critical. Whether you’re a short-term trader or a momentum follower, discipline will define profitability in this setup.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Please consult a financial advisor before making investment decisions.

Viraj Jain is an active stock market trader and technical analyst with a sharp eye for identifying trend-driven opportunities. Passionate about market movements and price behavior, he specializes in analyzing crucial support and resistance levels in high-momentum stocks. Viraj is dedicated to keeping fellow investors informed with timely stock updates, chart-based insights, and actionable technical analysis that bridges the gap between market noise and informed trading decisions.